ALL MARKETS TRADING COURSE LEVEL 2: TREND FOLLOWING ULTIMATE

18 Months Custom Email Support

Core Systems Trading Manual; 163 Pages

Exchange Traded Funds (ETF) Manual

LEAPs Options Manual

Single Stock Futures Manual

Money Management Manual and more!

$2,997.00

ENROLL IN COURSEPRODUCT DESCRIPTION

"The way I see it, you have two choices--you can do what I did and work for 30-plus years, cobbling together scraps of information, seeking to create a money-making strategy, or you can spend a few days reading Covel's book [Trend Following] and skip that three-decade learning curve." --Larry Hite, trend following legend

"Follow this System, and You'll Only Buy Markets that are Moving Higher. And You'll Only Sell Short Markets Moving Lower."

Michael Covel spent two decades creating proprietary systems that identify the start of market trends. These systems will, with 100% certainty, only find markets that are already moving higher. However, and this is critical, these systems will respond to any trend change (read: inflection point) leaving you protected from downside risk, i.e. crashes. Bottom line, you'll know exactly when to buy and when to sell and you'll always follow the primary trend giving you the chance to turn a grubstake into a fortune.

Yet trading for massive returns is hard when blocked out by daily fundamental nonsense:

"What is the right approach for investors faced with an unusually uncertain economic outlook and volatile markets?"

"Big concerns over job insecurity, consumer and corporate spending, and housing prices."

"Should you buy gold?"

"Where are markets headed?"

"Oil shock, dollar drop, Japanese earthquake, elections!"

That’s white noise.

There is no reason to be on that hamster wheel. You need a winning philosophy and strategy, backed by proven positive results that you can execute. Flagship provides the exact trend following rules, insights and psychology you need for a life-changing opportunity.

Now, consider the ugly truth most investors don't yet know:

- Market fundamentals are never 100% known.

- Expert predictions are bullsh--.

- Mutual funds profit only on rising markets.

- Long only funds see investors as marks.

- Fees for stock funds are a scam.

- Zero or negative rates are a rigged system.

- Technical analysis and chart reading is voodoo.

- Governments actively work against retirees.

- Wall Street engineers crashes like clockwork.

WHO BENEFITS?

Michael's work blows up those ugly truths. His trading rules work equally on all markets in all countries. These are rules you can literally trade from a desert island because you simply don't need daily news. These systems give the chance for big money in bull, bear and black swan markets.

"I don't have much experience… so can anyone really make money from these trades?"

YES.

Trend Following™ Flagship is for:

- Brand new investors and traders.

- Professionals and institutional investors.

- Buy and holders.

- Equities, FX (Forex), ETFs, commodities, LEAPs and futures traders.

- Fund managers and RIAs.

- Technical traders and chartists.

- College students.

- Retirees nailed by ZIRP and NIRP central bank policies.

- Anyone seeking above average profits in up, down or surprise markets.

Michael's systems leave customers fiercely loyal. They pay directly for out-side-the-box techniques that could end up funding their entire retirement. Could using this information, this process, allow you to catch "trends" in a systematic way and do it every single week?

YES.

For 20 years Michael (Bio) has traveled the world, from his hometown in Virginia outside Washington, D.C. to the UK to China to Brazil to Singapore, teaching more than 8,000 everyday investors and traders how to beat the market.

And, it all starts with a passion for revenge. In his mid-20s, fresh out of grad school armed with a useless MBA, Michael tried to land a trading job on Wall Street. But they told him he wasn’t qualified enough. After that, he made it his life’s mission to learn the best money-making strategies from the great traders... And teach every day investors how to beat Wall Street at their own game. He wrote four books about it... launched a podcast now with millions of listens... and even directed a documentary. All for everyday investors and traders.

And now he has developed the proprietary Flagship system for regular investors and traders who don’t want to wait decades to see big gains. Your journey, like Michael's, starts right now with essential truths imparted from a brilliant mentor:

- No one can predict the future.

- If you can take the would-be, could-be, should-be out of markets and look at what is actually happening you have a big advantage.

- What matters most can be measured, so always count.

- You don't need to know when something will happen to know that it will happen.

- Prices can only go up, down or sideways.

- Losses are a part of life.

- There is only now... so follow the trend.

THE DETAILS

For example, assume GOOG is trading between 650 and 670. All of a sudden GOOG jumps, or breaks out, to a price level of 700. That type of upward movement from a range is a trigger--the entry. You might say, "I don't know if GOOG is going to continue up, but it's been going sideways for six months, and all of a sudden, the price has jumped to 700 making a new six-month highest high. You don't argue with the market, you just say I'm in."

THAT'S TREND FOLLOWING THINKING.

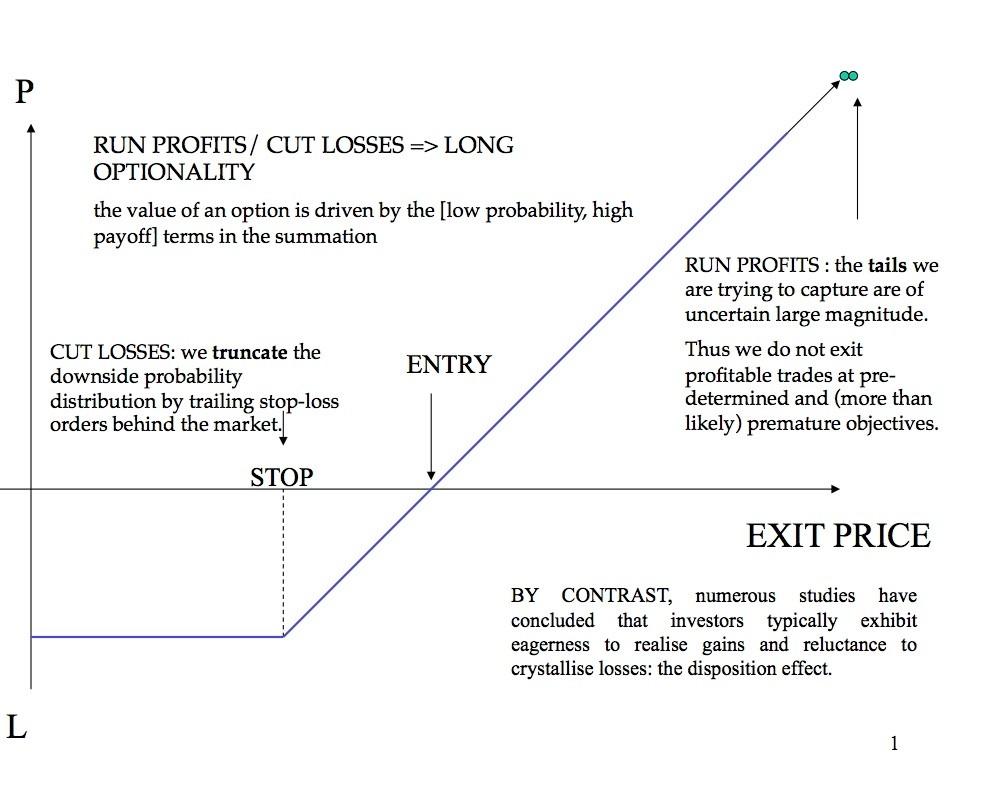

Consider this chart:

More examples: 1, 2, 3, 4, 5, 6, 7, 8.

Markets You Can Trade

Flagship systems can be used for all markets and instruments across all countries:

- Stocks: S&P, SSE Comp., Nikkei 225, DAX, AAPL, TSLA, FB, etc.

- Bonds / Interest Rates: Eurodollar, 10-Year T-Note, Bund, etc.

- Currencies / FX / Forex: USD, EUR, JPY, GBP, AUD, CHF, CNY, etc.

- Cryptocurrencies: Bitcoin, Ethereum, etc.

- Metals: Gold, Silver, Copper, etc.

- Energies: Oil, Natural Gas, etc.

- Agriculturals: Wheat, Corn, Soybeans, etc.

- Softs: Coffee, Sugar, Cotton, etc.

- Meats: Lean Hogs, Feeder Cattle, etc.

- Futures.

- Commodities.

- ETFs.

- LEAPS Options.

- Mutual Funds.

"How can I trade those markets? I know nothing about them!"

Fair point.

But it does not matter if you’re trading stocks or soybeans. Trading is trading, and the name of the game is to make money, not get an A in "How to Read a Balance Sheet." It's not about predicting when the S&P might crash or Tesla's 3rd quarter sales numbers.

Instead of trying to evaluate fundamentals that never end, trend following trades the market prices themselves.

You are now an expert in all markets.

Look, big money making starts with trends, or waves. Anyone who makes significant money rides waves. And guess what? No one can predict the next big one. The only certainty is that when the big wave comes, trend followers will surf the new beaches.

That simple-sounding ideology is instrumental for financial flexibility, as trend followers trade that same philosophy in all markets. You can storm into any moving market, be it an obscure currency or a stock in wild emerging markets. Trend following is agnostic to both the market and direction. It is a James Bond 007 license to pursue whatever market is flowing up or down.

You Will Learn Exact Rules

Michael's proprietary Trend Following™ systems answer these questions with mathematical precision:

- When do you enter and exit at all times?

- Where do you place stops for every position?

- How do you automate your trading?

- When do you adjust stops?

- When do you take a loss to avoid a larger loss?

- How do you balance longs and shorts?

- How do you adjust trades for new profits?

- How do you account for volatility?

- How do you adjust on winning/losing streaks?

- How do you adjust risk as an account grows?

- How do you protect against downside moves?

- How do you adjust your positions for volatility?

- What is the psychological component?

- How do you choose a portfolio?

Trend Following™ systems have also been reverse engineered to answer these questions:

- How do you exactly trade with the trend?

- How do you model the great traders?

- How do you manage risk with a written plan?

- How do you use a checklist in your trading?

- How do you trade off of today's price only?

- How do you avoid buying declining markets?

- How do you stay out of the market?

- How do you plan to exit before you enter?

- How do you plan for a worst-case scenario?

- How do you identify a portfolio and rank them?

- How do you trade with a small account?

- How much do you trade every time?

- When do you increase your position?

- How much do you risk at all times?

- How do you evaluate total market risk?

- How do you diversify your account?

- How do you avoid correlation among markets?

To be crystal clear: You will know every step to take, every price level to follow, every setup to execute and have every needed risk management tool to keep you in the game while positioning you for the big gain.

What Investors Are Saying

"The way I see it, you have two choices–you can do what I did and work for 30-plus years, cobbling together scraps of information, seeking to create a money-making strategy, or you can spend a few days reading Covel’s book and skip that three-decade learning curve." -Larry Hite, multi-billion hedge fund manager who has achieved a compounded annual rate of return greater than 30%.

"We have made Trend Following required reading for all of our employees. Michael is a great asset and a respected member of the trend following community." -Tim Pickering Founder and CIO, Auspice Capital Advisors

"I have to thank Mike for his in-depth research on this subject and a proven way for traders to make money – simply by following the trends. Mike's trading system course has made positive contributions to my success in trading and managing my clients' money." -Brendon W. in Chicago.

"Michael, I credit your two books as being essential to my transformation into a consistent, winning trader." -Andrew A. in St. Petersburg, FL.

"Trend Following" has changed my life, not only with trading, but also the way I view the world and live my life. If there is anyone who thinks trend following doesn’t work, please give them my information to contact me. I am a living, breathing example that it does." -Todd M. in New Jersey

"What really convinced me to follow this path is I recently met a trader that has been successfully trend trading for over five years using your methods. Thank you for making me aware of the ultimate retirement plan." -Mitch C. in California

"Out of all the trainers, lecturers and "gurus" I believe that none are better than Michael Covel in making complicated concepts clear and understandable. I consider Mike to be the "Best of the Best". Mike truly cares about his students and wants us to succeed." -Barry N. in California.

"Years ago, famed Chicago bond trader Tom Baldwin put trading in a phrase: 'Everybody wants the money, but whose willing to do the work?' I know a few. One of them is Michael Covel. Michael did the yeoman's duty no one else would do: bringing together the principles, practices and track records of trend following. In his now numerous books, courses and programs, he solidly demonstrates trend following is a viable trading and investment strategy; moreover, one that can be learned and mastered." -Charles Faulkner, Market Wizard Trading Coach

"I spent my professional career in the [trading] industry until my retirement in 2001. Through the years I have been asked many times for advice about how to attempt to be a successful trader. My answer: read and apply Covel." -Jack Z. in New York.

"Michael Covel is a rare breed. He is the only author I have come across who really understands how traders can make money, regularly and consistently over a long period of time. Unfortunately, the financial world has been hijacked by crooks, charlatans, bankers and investment advisers hoodwinking the general public into believing that buying and holding a financial asset over a long period of time is the right strategy. Michael Covel shines a light in this world and is indeed a rare breed. I cannot recommend his work enough." -Jad T., a trader in Chicago

"Mike Covel is not just a cheerleader for trend-following, he is the Head Coach. He understands the game, the strategy and crucially the psyche of the players. Would-be winners will ensure that they study Mike's teachings and books before stepping onto the playing field. His books ARE required reading here for all our traders, marketers and interns." -Christopher C, Chief Executive Officer at Insch Capital Management.

"Never mind how much money these teachings have made me. Their biggest benefit so far has been how much they have SAVED me. Trend following helped me sail through the Global financial crisis relatively unscathed. Mike truly has access to some of the greatest trend following minds around, no mean feat given the majority of these players shun the public eye. I have find his guidance from afar extremely helpful." -Darren R. in Australia.

"I started trading roughly 10 years ago as a typical discretionary trader. I eventually realized my emotions were too strong and I lived in fear, glued to the screen watching every tick of market data. I hated it, but I felt like I had to do it. I spent hours researching stocks for the fundamentals, etc. As a software engineer and private pilot, I knew there had to be a better way. 100% systematic trading has helped me get my life back." -Michael H.

"I decided to contact Mike and work with him one on one. This experience has put me in a new league and really helped me focus on my weak areas which were risk management and portfolio selection. I would recommend any trader who is not where they want to be to start with Mike." -Steve Burns

MICHAEL COVEL'S ALL MARKET TRADING COURSES

For stocks, currencies (fx), rates, energies, futures, etfs, leaps and crypto

LEVEL 1: TURTLETRADER PRICE ACTION

$997

Turtle Rules + Philosophy

Guide to ETFs

Guide to Futures

Portfolio Examples

Money Psychology and Skill Development

Turtle Audio Interviews

Turtle Performance Reports

LEVEL 2: TREND FOLLOWING ULTIMATE

$2,997

Core Systems Trading Manual

Exchange Traded Funds Manual

LEAPs Options Manual

Single Stock Futures Manual

Money Management Manual

Additional Trend Following Systems

Alternate Entries Manual

Expanded Human Behavior Guide

Trade Walkthrough

Trend Following Wizard Videos

Trend Following Audio Training

COURSE BUNDLE: ALL MARKETS TRADING COURSE LEVEL 1+2

$3,497

All Level 1: TurtleTrader Price Action Course Contents

All Level 2: Trend Following Ultimate Course Contents

Trend Following Home Runs

The Babe Ruth parallel:

"What is striking is that the leading thinkers across varied fields — including horse betting, casino gambling, and investing — all emphasize the same point. We call it the Babe Ruth effect: even though Ruth struck out a lot, he was one of baseball’s greatest hitters."

His home runs paid for the strikeouts, but people don't get that as one Silicon Valley venture capitalist notes:

"The Babe Ruth effect is hard to internalize because people are generally predisposed to avoid losses. Behavioral economists have famously demonstrated that people feel a lot worse about losses of a given size than they feel good about gains of the same size. Losing money feels bad, even if it is part of an investment strategy that succeeds in aggregate."

You can’t have trend following grand slams without a fair share of trend following strikeouts. Accept that principle and you are on your way to understanding how 20x, 50x, etc. can be made on your money.

Questions? Email.

"The way I see it, you have two choices–you can do what I did and work for 30-plus years, cobbling together scraps of information, seeking to create a money-making strategy, or you can spend a few days reading Covel’s book and skip that three-decade learning curve."

Larry Hite, famed hedge fund manager who achieved a compounded annual rate of return greater than 30%.

MICHAEL COVEL'S ALL MARKET TRADING COURSES

For stocks, currencies (fx), rates, energies, futures, etfs, leaps and crypto

LEVEL 1: TURTLETRADER PRICE ACTION

$997

Turtle Rules + Philosophy

Guide to ETFs

Guide to Futures

Portfolio Examples

Money Psychology and Skill Development

Turtle Audio Interviews

Turtle Performance Reports

LEVEL 2: TREND FOLLOWING ULTIMATE

$2,997

Core Systems Trading Manual

Exchange Traded Funds Manual

LEAPs Options Manual

Single Stock Futures Manual

Money Management Manual

Additional Trend Following Systems

Alternate Entries Manual

Expanded Human Behavior Guide

Trade Walkthrough

Trend Following Wizard Videos

Trend Following Audio Training

COURSE BUNDLE: ALL MARKETS TRADING COURSE LEVEL 1+2

$3,497

All Level 1: TurtleTrader Price Action Course Contents

All Level 2: Trend Following Ultimate Course Contents

FAQS

Q: Who is turtle trend following for?

A: Everyone (almost):

• All new or private traders trading their own account.

• All account sizes.

• Hedge fund managers, commodity trading advisors, floor traders and locals.

• Professional traders looking to establish money management businesses.

• Those that trade 401K, IRA, or other retirement vehicles.

• Those that want to trade all markets with the same rules.

• Those that want to make money in bull, bear and black swan markets.

This is for brand new to pro traders. It is for traders that trade global markets and for those that trade only their home country markets. It is for retirement, speculative accounts, Registered Investment Advisors, fund managers and college students. This is a true location independent, trade on a desert island trading profit-making opportunity.

Q: Who is this not for?

A: For starters:

• Those expecting billions instantly.

• Day traders.

• People who think they can predict tomorrow.

• Anyone who says this: “Identifying and exploiting anomalies in price action fast is the key to profitable trading.”

• If you are not attached to reality we will be a very bad match.

Q: Please define trend following.

A: Trend following does not pick bottoms or tops. You always get into a trend late, and get out late. You cannot predict a trend. The foundation of one of the most profitable insights in the history of market speculation: capture the middle meat of a trend and you can make a fortune.

Q: Is this fancy software and complicated trading strategies that seemingly only rocket scientists can trade?

A: No. The real risk in today’s age is over-doing a trading system. There is so much computing power available and so much data available, but the reality is that trend following rules can be explained on the back of a napkin. You will learn to use rules that anyone can apply for potential profit. Can software help automate trend following strategies? Sure, but don’t let automation fool you. Consider wisdom from Daniel Dennett:

“Here is something we know with well-nigh perfect certainty: nothing physically inexplicable plays a role in any computer program, no heretofore unimagined force fields, no mysterious quantum shenanigans. There is certainly no wonder tissue in any computer. We know exactly how the basic tasks are accomplished in computers, and how they can be composed into more and more complex tasks, and we can explain these constructed competences with no residual mystery. So although the virtuosity of today’s computers continues to amaze us, the computers themselves, as machines, are as mundane as can-openers. Lots of prestidigitation, but no real magic…All the improvements in computers since Turing invented his imaginary paper-tape machine are simply ways of making them faster.“

One of the most accomplished trend following traders of the last 30 years, a man that has made billions, still tracks and automates his world with EXCEL. Nothing fancy. No mental masturbation.

Q: Does your product come with recommendations?

A: You will know all trades to take for all markets at all times. You won’t need ongoing ‘recommendations’ as you will have all from the start. My trend following systems give you the rules for your ongoing trade signals (what some might call recommendations).

Q: Is trend following trading black box system trading?

A: This is not black box trading. All rules and philosophies taught are fully disclosed.

Q: When does trend following work?

A: When markets trend–is the short answer. The investment objective of my trading programs is to extract profits from up, down and black swan markets (rare or surprise events), resulting in an above average return stream. All programs can be applied to long only and long/short portfolios and all rules are best applied in a 100% systematic manner. Think of it like a machine:

Q: What type of markets can be traded?

A: Systems provided are for stocks, bonds, commodities, currencies (FX), energies, agriculturals, metals and softs. Even BTC. Can you trade equities only, for example? Yes.

Q: What market instruments can be traded?

A: Systems provided are for equity ETFs (equities), LEAPs options and or futures.

Q: How detailed is your product?

A: You will receive:

• Exact rules for selecting your tracking portfolio.

• Exact rules for entering your trades at the right time.

• Exact rules for exiting your trades with a loss.

• Exact rules for exiting your trades with a profit.

• Exact rules for how much money to bet on each trade.

Q: What is the difference between your books and systems & training?

A: The books are great resources filled with thousands of details, and they have helped many traders make money, but my systems and training with support are different. Questions come up. People need help. Personal instruction gives insights. Additionally, many proprietary trading systems are included (not in the books).

Q: Is trend trading only for the USA?

A: My clients are in 70+ countries trading on exchanges from Europe to Asia to the Middle East to South America to North America.

Q: Are your systems and training for the individual investor?

A: Many of my clients are simply individuals trading their own account. Many are with no experience. Some have experience, but the wrong kind. Whether 21 and in college, age 30 working a job, or age 75 in retirement, you can learn trend following trading.

Q: Are your systems and training for market professionals?

A: My systems and training are also used by experienced traders worldwide. Hedge fund managers to CTAs to CFAs to CMTs brokers to financial advisers on every continent.

Q: Can systems be applied to shorter time frames like hourly or 4-hour charts? Does Day Trading Work in Conjunction with Trend Following?

A: No. Day trading is fool’s gold. My systems and training will be worth millions to you over a lifetime if you simply understand that day trading is a mirage.

Q: This is for retirement accounts?

A: You can trade equities, futures and ETFs in retirement accounts (401ks, IRAs, Keoghs, Seps, etc.).

Q: Trend following works on stocks?

A: Yes. 100%. Trend following is not instrument specific. Trend followers can and do trade all types of instruments. Some trade futures. Some trade ETFs. Some trade LEAPS® options. Some trade commodities. For example, today trend following traders can trade ETFs and get exposure to stock and commodities markets without having to trade futures. You will learn the best option for your situation.

Q: Is trend following risky?

A: Life is risky. You might get hit by a car crossing the street. However, if you have a concrete plan, risk can be managed.

Q: Do university classes assist in trend following education?

A: Most finance departments either are unaware of trend following or ignore it. Many of the greatest traders had little to no experience trend trading before starting. Trend following legend John W. Henry (owner of Boston Red Sox), for example, did not have a college degree.

Q: Do trend followers watch screens during market hours?

A: Some trend followers only trade once a week using weekly bars. There is no need to watch the screen during market hours.

Q: How much time is required to trade as a trend following trader?

A: You can spend a minute or two per market each day. For example, you check prices in the evening, then with one trade in the morning, you place or change any orders in accordance with rules. Flagship trend following trading systems use daily data to determine buy and sell signals. Orders can be placed before the market opens and do not need hourly monitoring. Most top traders manage their trades in 10 to 30 minutes per day. Trend follower Richard Donchian:

“If you trade on a definite trend-following loss limiting-method, you can trade without taking a great deal of time from your regular business day. Since action is taken only when certain evidence is registered, you can spend a minute or two per [market] in the evening checking up on whether action-taking evidence is apparent, and then in one telephone call in the morning place or change any orders in accord with what is indicated. [Furthermore] a definite method, which at all times includes precise criteria for closing out one’s losing trades promptly, avoids…emotionally unnerving indecision.”

Each day you determine entries and or exits for the following day. You can then buy or sell “at the market” on the open the next day.

Q: Can your trend following strategies be automated?

A: Yes.

Q: Are markets different now?

A: Markets are always the same because they always change. Trend following trading adapts to constant change. That’s the way to look at it. If someone says markets have changed, reach your wallet. You are about to be picked. Alan Watts the philosopher makes the case for how trend following responds to constant change:

“If, when swimming, you are caught in a strong current, it is fatal to resist. You must swim with it and gradually edge to the side. One who falls from a height with stiff limbs will break them, but if he relaxes like a cat he will fall safely. A building without give in its structure will easily collapse in storm or earthquake.”

Q: Is 24-hour news needed?

A: You don’t need real-time data or news. In fact, you don’t need news at all to be a trend following trader.

Q: Is leverage used in trend following?

A: All great traders use leverage. It is a tool to be used correctly. However, trend following is not about using reckless leverage (like Wall Street banks).

Q: Once training is completed is a broker or financial adviser needed?

A: No.

Q: What do you think of Gann and Elliott Wave?

A: Nice version: waste of time. True version: con.

Q: What additional expenses are needed?

A: You need money to trade and daily price data (about $20-50/month). My clients also receive a special 10% discount with CSI Data (a world data leader).

Q: Are chart techniques used to pick entry levels, exit levels and where to place stop levels? Do you teach a one-size-fits-all method of level picking or do you tailor it to the individual?

A: No chart techniques are used, but you will know exactly your entry, exit and where to place stops. The rules taught can be tailored, absolutely.

Q: Speak to non-USA markets, i.e. China, Malaysia, Singapore, Brazil, Indonesia, etc.

A: Trend following is for all markets, all countries.

Q: Do your rules help to profit during crashes and tail events?

A: Yes. Making money from black swans, surprises, tail events and crashes is core to trend following success. Think about the “edges”:

Q: Are too many people trading as trend following traders?

A: Broadly speaking the amount of money trading globally applied to trend following methods is tiny by comparison to the mountain of money stuck in buy and hold mutual funds. The opportunity for trend following success is massive.

Q: What are your main criteria to identify a trend?

A: In trend following you don’t do that. In trend following you take entry signals, and have exit signals. After an entry and then exit you can historically identify a trend. Anyone saying they can spot or predict trends in real time is incorrect.

Q: Assuming that I decide to quit my day job working for the man and become a trader, how do I get access to the markets? How do I do research? Do I need to have access to real-time and historical data?

A: You will need a broker and you will need market data (not real time). I help understand on both issues with recommendations. The research? I provide that too.

Q: Michael would probably crush me for asking this, but I’ll ask it anyway: Is trend following a full time job? It is a big commitment and I’d like to know if it can be done part time?

A: You can be part-time. 100%. You will not be day trading. You can trade using daily or weekly closing prices. No other strategy allows this.

Q: What makes your product different than others?

A: We don’t compare to unnamed others. My one of a kind product is not a commodity. You can only receive it here.

Disclaimers

Trend Following™ can not promise you will earn the returns of traders, charts or examples (real or hypothetical) stated. All past performance is not necessarily an indication of future results. Data presented is for educational purposes. Our products are also provided for informational purposes only and should not be construed as personalized investment advice. All data on this site is direct from the CFTC, SEC, Yahoo Finance, Google and disclosure documents by managers mentioned herein. Trend Following™ assumes all data to be accurate, but assumes no responsibility for errors, omissions or clerical errors made by sources.

Our testimonials are the words of real clients received in real correspondence that have not been paid for their testimonials. Testimonials are sometimes printed under aliases to protect privacy, and edited for length. Claims have not been independently verified or audited for accuracy. We do not know how much money was risked, what portion of their total portfolio was allocated, or their exact positions. We do not claim that the results experienced by such clients are typical and you will likely have different results.

Trend Following™ is not registered as a securities broker-dealer or an investment adviser. This information is not designed to be used as an invitation for investment with any adviser profiled. No information herein is intended as securities brokerage, investment, tax, accounting or legal advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

Further, Trend Following™ cannot and does not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. The reader bears responsibility for his/her own investment research and decisions, should seek the advice of a qualified securities professional before making any investment, and investigate and fully understand any and all risks before investing.

Additionally, Trend Following™ in no way warrants the solvency, financial condition, or investment advisability of any security or instrument. In addition, Trend Following™ accepts no liability whatsoever for any direct or consequential loss arising from any use of this information. This information is not intended to be used as a basis of any investment decision, nor should it be construed as advice designed to meet the investment needs of any particular investor.

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.